From Bretton Woods to the 1990s: A Journey Through the Evolution of the Global Monetary System

The Birth of Bretton Woods

In the aftermath of the devastation of World War II, the world was in desperate need of a new international monetary system. The old system, based on the gold standard, had collapsed in the 1930s, contributing to the Great Depression. In 1944, representatives from 44 countries met in Bretton Woods, New Hampshire, to create a new system that would promote global economic stability and growth.

4.4 out of 5

| Language | : | English |

| File size | : | 530 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

The Bretton Woods Agreement established a system of fixed exchange rates, with the US dollar pegged to gold at a rate of $35 per ounce. Other currencies were pegged to the dollar, creating a stable system of exchange rates that facilitated international trade and investment.

The Bretton Woods system also established the International Monetary Fund (IMF) and the World Bank. The IMF was created to provide short-term loans to countries facing balance of payments problems, while the World Bank was created to provide long-term loans for infrastructure projects and other development initiatives.

The End of Bretton Woods

The Bretton Woods system worked well for several decades, but it came under increasing strain in the late 1960s and early 1970s. The US dollar came under pressure as the US ran large balance of payments deficits, and other countries began to accumulate large reserves of dollars.

In 1971, the US suspended the convertibility of the dollar into gold, effectively ending the Bretton Woods system. This led to a period of floating exchange rates, in which the value of currencies was determined by market forces.

The Rise of the Euro

In the 1990s, the European Union (EU) launched the euro, a single currency for all of its member states. The euro was designed to promote economic integration and stability within the EU, and it has since become one of the world's most important currencies.

The Asian Financial Crisis

In 1997, the Asian financial crisis erupted, causing a sharp decline in the value of several Asian currencies. The crisis was triggered by a combination of factors, including overinvestment, currency speculation, and a lack of financial regulation.

The Asian financial crisis had a significant impact on the global economy, and it led to a reassessment of the role of the IMF. The IMF was criticized for its handling of the crisis, and it was forced to make changes to its lending policies.

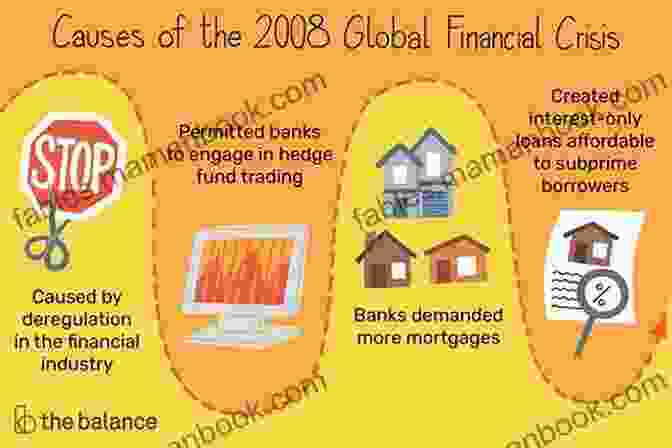

The Global Financial Crisis

The global financial crisis of 2008 was the most severe financial crisis since the Great Depression. The crisis was triggered by a combination of factors, including subprime lending, excessive leverage, and a lack of financial regulation.

The global financial crisis had a devastating impact on the global economy, and it led to a renewed focus on financial regulation. The Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in 2010 in an effort to prevent another financial crisis from occurring.

The Future of the Global Monetary System

The global monetary system has evolved significantly since the Bretton Woods era. The future of the system is uncertain, but there are a number of trends that are likely to shape its future.

One trend is the rise of digital currencies. Digital currencies, such as Bitcoin, are not backed by any central bank, and they are not subject to government regulation. Digital currencies have the potential to revolutionize the way that we think about money and finance.

Another trend is the increasing interconnectedness of the global economy. The global financial crisis demonstrated the interconnectedness of the global economy, and it is likely that this interconnectedness will continue to increase in the future.

The future of the global monetary system is uncertain, but it is clear that the system is facing a number of challenges. These challenges include the rise of digital currencies, the increasing interconnectedness of the global economy, and the need for financial stability. It is important to note that the global monetary system is not static, and it will continue to evolve in response to the changing needs of the global economy.

4.4 out of 5

| Language | : | English |

| File size | : | 530 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Maria Andreadelli

Maria Andreadelli Katie Edmonds Ntc

Katie Edmonds Ntc John R Finger

John R Finger Mark Bacera

Mark Bacera James Kestrel

James Kestrel Margaret Kay

Margaret Kay Axel Englund

Axel Englund Anna Goldthorpe

Anna Goldthorpe Terri A Erbacher

Terri A Erbacher Erin Shields

Erin Shields Refaat Alareer

Refaat Alareer Mary Deal

Mary Deal Jackie Kabler

Jackie Kabler Bobby Blaze Smedley

Bobby Blaze Smedley Allan Gurganus

Allan Gurganus Sylvie Baumgartel

Sylvie Baumgartel Michael Wood

Michael Wood Victor W Rodwell

Victor W Rodwell Roland Ennos

Roland Ennos Tiana Laveen

Tiana Laveen

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ibrahim BlairDeath Squad: The Executioner - An In-Depth Exploration of the Controversial...

Ibrahim BlairDeath Squad: The Executioner - An In-Depth Exploration of the Controversial...

Roger TurnerDelve into the Symphony of Two: Exploring the Enchanting World of Piano Duets

Roger TurnerDelve into the Symphony of Two: Exploring the Enchanting World of Piano Duets John Dos PassosFollow ·12.7k

John Dos PassosFollow ·12.7k Kenzaburō ŌeFollow ·18.4k

Kenzaburō ŌeFollow ·18.4k Evan SimmonsFollow ·17.9k

Evan SimmonsFollow ·17.9k Felix HayesFollow ·18.4k

Felix HayesFollow ·18.4k William ShakespeareFollow ·7.8k

William ShakespeareFollow ·7.8k D'Angelo CarterFollow ·14.3k

D'Angelo CarterFollow ·14.3k Herman MitchellFollow ·17.3k

Herman MitchellFollow ·17.3k Colby CoxFollow ·4.7k

Colby CoxFollow ·4.7k

Carlos Drummond

Carlos DrummondDiscover the Culinary Treasures of Texas: The Lone Star...

Exploring the Flavors of the Lone Star...

Tim Reed

Tim ReedHow To Be Okay When Things Are Not Okay: A Comprehensive...

Life is full of...

John Green

John GreenUnveiling the Intricacies of "Novel of Duplicity": A...

In the realm of literary...

Tyrone Powell

Tyrone PowellThe Essential Guide to Teaching the El Education Language...

The El Education Language Arts...

Forrest Blair

Forrest BlairChoral Mediations In Greek Tragedy

In the vibrant tapestry of Greek tragedy,...

Evan Simmons

Evan SimmonsPrem Baby 8ply Lace Beanie Knitting Pattern - Carly

Welcome to...

4.4 out of 5

| Language | : | English |

| File size | : | 530 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |